Fascination About Small Business Accounting Service In Vancouver

Wiki Article

The Facts About Small Business Accounting Service In Vancouver Revealed

Table of ContentsThe Ultimate Guide To Cfo Company VancouverAbout Small Business Accounting Service In VancouverThings about Outsourced Cfo ServicesThe 25-Second Trick For Virtual Cfo In Vancouver

That takes place for every solitary purchase you make throughout an offered audit period. Functioning with an accounting professional can aid you hash out those information to make the accounting process job for you.

What do you make with those numbers? You make changes to the journal entrances to see to it all the numbers accumulate. That may include making adjustments to numbers or handling built up products, which are expenditures or earnings that you incur yet don't yet pay for. That obtains you to the readjusted test equilibrium where all the numbers build up.

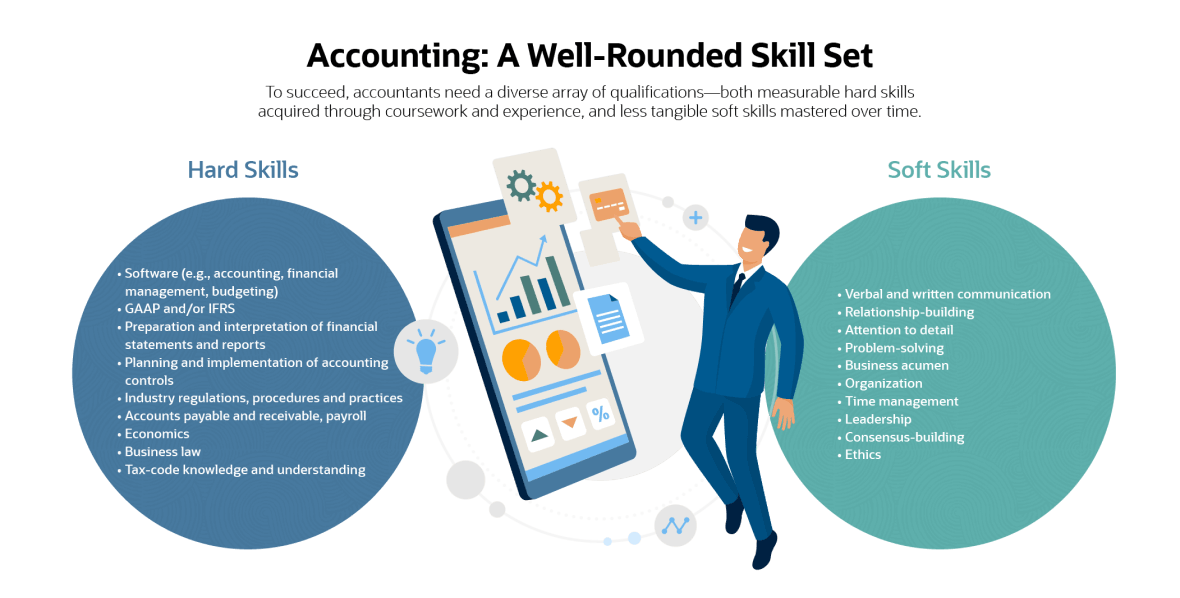

Accountants and accountants take the very same fundamental accountancy programs. This guide will supply an in-depth malfunction of what separates accountants from accountants, so you can comprehend which bookkeeping duty is the best fit for your job goals now and also in the future.

Excitement About Cfo Company Vancouver

An accountant improves the details offered to them by the bookkeeper. Generally, they'll: Evaluation monetary statements prepared by an accountant. Examine, interpret or confirm to this details. Transform the information (or documents) right into a record. Share advice as well as make recommendations based on what they've reported. The records reported by the bookkeeper will identify the accounting professional's advice to leadership, and also inevitably, the wellness of the company in general.e., federal government agencies, colleges, health centers, and so on). An experienced as well as competent bookkeeper with years of experience and also first-hand expertise of audit applications ismost likelymore certified to run the books for your business than a recent bookkeeping major grad. Keep this in mind when filtering system applications; try not to judge applicants based on their education alone.

Future forecasts as well as budgeting can make or break your service. Your monetary records will play a massive duty when it pertains to this. Service estimates and trends are based on your historic economic information. They are needed to aid guarantee your company continues to be rewarding. The financial information is most reputable and also accurate when supplied with find this a durable and organized audit procedure.

The Of Virtual Cfo In Vancouver

Bookkeeping, in the standard feeling, has been about as long as there has been business since around 2600 B.C. An accountant's job is to preserve total documents of all cash that has entered into as well as gone out of the company - Pivot Advantage Accounting and Advisory Inc. in Vancouver. Bookkeepers document everyday transactions in a constant, easy-to-read way. Their documents allow accountants to do their work.Typically, an accounting professional or proprietor supervises an accountant's job. A bookkeeper is not an accountant, neither ought to they be taken into consideration an accountant. Bookkeepers document financial purchases, blog post debits and credit scores, produce invoices, handle pay-roll and also keep and also balance guides. Bookkeepers aren't called for to be accredited to deal with guides for their customers or company but licensing is offered.

3 major aspects impact your costs: the services you want, the proficiency you require as well as your neighborhood market. The bookkeeping solutions your business requirements and the amount of time it takes regular or regular monthly to complete them influence how much it costs to hire a tax tax tax bookkeeper. If you need someone to come to the workplace as soon as a month to reconcile the books, it will cost much less than if you require to employ a person full time to manage your day-to-day procedures.

Based on that computation, decide if you need to hire a person permanent, part-time or on a job basis. If you have complicated publications or are generating a great deal of sales, employ a certified or qualified bookkeeper. A skilled accountant can offer you satisfaction and self-confidence that your funds remain in good hands however they will also cost you extra.

Our Vancouver Accounting Firm Ideas

If you live in a high-wage state like New York, you'll pay more for a bookkeeper than you would certainly in South Dakota. There are several benefits to hiring an accountant to submit and also record your organization's monetary records.

They may pursue additional certifications, such as the Certified public accountant. Accountants might additionally hold the placement of bookkeeper. If your accountant does your accounting, you might be paying even more than you must for this service as you would usually pay more per hour for an accounting professional than an accountant.

To complete the program, accounting professionals should have 4 years of relevant job experience. CFAs should also pass a tough three-part exam that had a pass price of only 39 percent in September 2021 - virtual CFO in Vancouver. The factor below is that employing a CFA implies bringing highly advanced accountancy expertise to your business.

To get this accreditation, an accountant needs to pass the called for examinations find here and have two years of professional experience. You may work with a CIA if you desire a much more specific focus on economic danger evaluation and safety monitoring processes.

Report this wiki page